In this comprehensive guide, we will delve into An Executive Architect’s Approach to FinOps: How AI and Automation Streamline Data Management.

In today’s rapidly evolving digital landscape, the role of an executive architect in financial operations (FinOps) has become more crucial than ever. The global generative AI market in finance is expected to rise from 1.09 billion U.S. dollars in 2023 to 9.48 billion U.S. dollars in 2032. With the advent of artificial intelligence (AI) and automation, the management of data has been revolutionized, offering unprecedented opportunities for streamlining processes and driving efficiency.

| Global Generative AI Market in Finance | Value |

|---|---|

| Market Value (2023) | $1.09 Billion |

| Projected Market Value (2032) | $9.48 Billion |

| CAGR (2023-2032) | 27.3% |

| Source | Statista |

Understanding the Role of FinOps in Modern Business Strategy

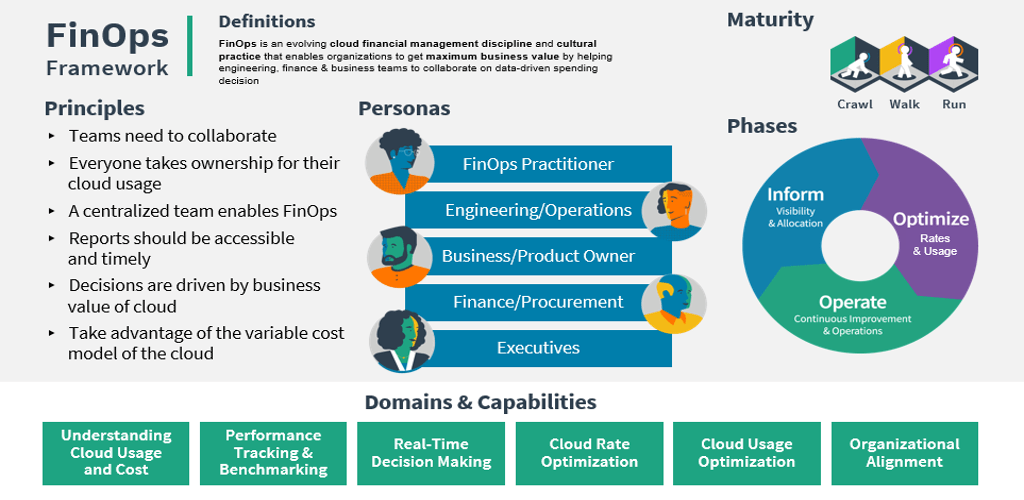

In the realm of modern business strategy, the function and strategic importance of FinOps cannot be overstated. As organizations increasingly migrate to cloud-based operations, the necessity for an integrated approach combining financial discipline, cloud optimization, and business performance has become paramount.

This multifaceted role demands a profound comprehension of both the technological landscape and financial governance, establishing a bridge that not only aligns but actively drives business goals and outcomes.

At its core, FinOps embodies the synthesis of financial accountability and operational excellence, enabling businesses to maximize the value of their cloud investments. This integration is crucial for executive architects, who are tasked with navigating the complex interplay between cost management, resource allocation, and strategic investment to foster growth and innovation.

By adopting a FinOps mindset, executive architects position their organizations to achieve agile, scalable, and financially efficient operations that respond dynamically to market demands.

The evolving nature of cloud services, with its consumption-based pricing models, necessitates a shift from traditional capital expenditure (CapEx) models to more flexible operational expenditure (OpEx) strategies. This transition underscores the importance of FinOps, as it provides the frameworks and practices required for managing cloud costs effectively, ensuring that investments are closely aligned with business outcomes.

Moreover, the role of FinOps extends beyond mere cost control. It encompasses the optimization of cloud resources to achieve enhanced performance, security, and compliance standards. Executive architects leveraging FinOps principles are better equipped to make informed, data-driven decisions that propel their organizations forward in a competitive digital landscape.

In essence, the strategic incorporation of FinOps into business planning is not a mere option but a necessity for companies aiming to thrive in the digital era. It demands a holistic view of the organization’s financial and operational landscapes, ensuring that every technological investment is a step toward achieving overarching business objectives.

| Aspect | Description |

|---|---|

| Definition | FinOps combines financial discipline, cloud optimization, and business performance to maximize value from cloud investments. |

| Importance | Essential for aligning financial governance with technological landscape, driving business goals and outcomes. |

| Key Functions | Cost management, resource allocation, strategic investment, performance optimization, security, and compliance. |

| Transition from CapEx to OpEx | Shift to operational expenditure (OpEx) strategies due to cloud services’ consumption-based pricing models. |

| Impact on Executive Architects | Requires navigating cost management, resource allocation, and strategic investment to foster growth and innovation. |

| Strategic Necessity | Incorporation of FinOps is crucial for achieving agile, scalable, and financially efficient operations responsive to market demands. |

The Imperative for AI and Automation in Data Management

In the dynamic realm of data management, the imperative for integrating AI and automation has never been more pronounced. As organizations grapple with the vast amounts of data generated every day, traditional manual methods of handling and analyzing data have become increasingly untenable. The integration of AI and automation emerges not just as a strategic advantage but as a critical necessity for businesses aiming to maintain competitiveness and operational efficiency in an information-saturated marketplace.

AI and automation bring to the table unparalleled capabilities for processing, analyzing, and managing data at a scale and speed that far surpass human ability. These technologies enable the identification of actionable insights from massive datasets in real time, facilitating more informed decision-making processes and enabling a proactive rather than reactive approach to challenges.

Furthermore, AI-driven analytics can uncover patterns and trends that might elude human analysts, offering a deeper understanding of market dynamics, customer behavior, and operational efficiencies.

The automation of routine and repetitive tasks, a hallmark of AI applications, not only boosts productivity but also liberates human capital to focus on more complex and strategic activities. This shift not only enhances job satisfaction among employees but also drives innovation and creativity within the organization.

Moreover, AI and automation contribute significantly to reducing errors associated with manual data management, enhancing the accuracy and reliability of financial reports, forecasts, and strategic planning endeavors.

Yet, embracing AI and automation in data management extends beyond operational efficiencies and competitive advantages. It is a strategic move towards building a resilient and agile business capable of adapting to rapid market changes and emerging technological trends. As data continues to grow in volume, variety, and velocity, the deployment of AI and automation becomes not just an option but an imperative for executive architects dedicated to steering their organizations towards sustainable success and growth in the digital era.

| Aspect | Description |

|---|---|

| Data Management Challenges | Traditional manual methods are increasingly untenable due to vast amounts of data generated daily. |

| AI Capabilities | AI processes, analyzes, and manages data at a scale and speed far surpassing human ability, enabling real-time insights and proactive decision-making. |

| Automation Benefits | Automates routine tasks, boosts productivity, reduces errors, and allows human capital to focus on complex strategic activities. |

| Strategic Advantages | Enhances operational efficiency, competitiveness, and adaptability to rapid market changes and technological trends. |

| Organizational Impact | Builds a resilient and agile business capable of sustainable success and growth in the digital era. |

Laying the Groundwork: Preparing for AI and Automation Integration

Embarking on the journey toward integrating AI and automation into FinOps begins with a comprehensive preparation phase, critical for ensuring a successful transition. This groundwork lays the foundation for a seamless integration, characterized by strategic alignment and operational readiness.

- First and foremost, it is imperative to conduct an in-depth analysis of current financial operations, identifying areas where AI and automation could bring about the most significant improvements in efficiency and accuracy. This evaluation should encompass not only existing processes but also the underlying data architecture, to ascertain the compatibility with AI technologies and automation tools.

- Following this, organizations must undertake a skills assessment to determine the internal capabilities available and identify any gaps that might necessitate training or hiring. It’s crucial to foster a culture of continuous learning and innovation, empowering employees to adapt to new technologies and methodologies effectively.

- Moreover, developing a robust data governance framework is essential, ensuring data quality, security, and compliance are maintained as AI and automation tools are deployed. This involves setting clear policies on data access, usage, and protection, alongside establishing accountability mechanisms.

- Finally, crafting a detailed implementation roadmap is vital, outlining the phases of integration, key milestones, and specific objectives.

This roadmap should also include a risk management plan, highlighting potential challenges and delineating strategies to mitigate these risks. Through meticulous planning and strategic foresight, organizations can navigate the complexities of AI and automation integration, laying a solid foundation for enhanced FinOps efficiency and agility.

| Aspect | Description |

|---|---|

| Analysis of Current Operations | Evaluate current financial operations and data architecture to identify areas for AI and automation improvements. |

| Skills Assessment | Determine internal capabilities and identify gaps for training or hiring. |

| Data Governance Framework | Ensure data quality, security, and compliance with clear policies on data access, usage, and protection. |

| Implementation Roadmap | Develop a roadmap outlining phases of integration, key milestones, objectives, and risk management strategies. |

Strategic Planning for AI-Driven FinOps

To embark on a journey toward AI-driven FinOps, strategic planning is paramount. This process begins with a clear vision of the organization’s objectives, aligning AI and automation initiatives with business goals to ensure they contribute meaningfully to the company’s growth and efficiency.

- Establishing a multi-disciplinary team comprising financial analysts, data scientists, IT specialists, and strategic planners is crucial for fostering a collaborative environment where diverse perspectives drive innovation. This team is tasked with identifying key areas within FinOps where AI can deliver significant value, such as predictive analytics for better budget forecasting, automated anomaly detection for cost reduction, or dynamic resource allocation for optimized cloud spending.

- Next, setting realistic timelines and milestones is essential for tracking progress and maintaining momentum. This includes prioritizing initiatives based on potential impact and feasibility, ensuring early wins that build confidence and support for the AI integration journey.

- Developing a comprehensive data strategy is also critical, focusing on the acquisition, normalization, and analysis of quality data, which serves as the foundation for effective AI solutions.

- Furthermore, it is important to assess the technological infrastructure to identify any upgrades or modifications needed to support AI and automation tools. This may involve investing in cloud services, advanced analytics platforms, or cybersecurity measures to protect sensitive financial data.

By meticulously planning each step of the AI integration process, organizations can navigate the complexities of digital transformation in FinOps, ensuring that their strategies are both forward-looking and firmly rooted in achieving operational excellence and financial robustness.

| Aspect | Description |

|---|---|

| Vision and Objectives | Align AI and automation initiatives with business goals for meaningful contribution to growth and efficiency. |

| Multi-Disciplinary Team | Form a team of financial analysts, data scientists, IT specialists, and strategic planners for collaboration. |

| Data Strategy | Focus on acquisition, normalization, and analysis of quality data for effective AI solutions. |

| Technological Infrastructure Assessment | Identify necessary upgrades or modifications to support AI and automation tools, including cloud services and cybersecurity measures. |

Choosing the Right AI and Automation Tools for Your Needs

Selecting the appropriate AI and automation tools is a critical decision that can significantly influence the success of your FinOps strategy. It involves a comprehensive evaluation of your organization’s specific requirements, current technological infrastructure, and long-term financial goals.

- Begin by identifying the challenges and bottlenecks within your financial operations that could benefit from automation and enhanced AI analytics.

- Evaluate tools based on their ability to integrate seamlessly with your existing systems, the scalability they offer to accommodate future growth, and their compliance with industry standards and regulations.

- Engage with vendors to understand the technical support and training they provide, ensuring your team can effectively utilize these tools. Consider the user experience; tools that are intuitive and easy to use will facilitate quicker adoption among your staff.

- Moreover, assess the financial implications, including the cost of implementation, maintenance, and any required upgrades over time. Select solutions that offer robust analytics capabilities, enabling deeper insights into cost management, budget forecasting, and optimization opportunities.

- Lastly, prioritize tools that are backed by a strong community or ecosystem. This can provide invaluable resources, from troubleshooting support to innovative ideas for leveraging the tool more effectively.

By meticulously evaluating your options, you can ensure the chosen AI and automation tools align with your FinOps objectives, driving efficiency, and fostering a culture of continuous improvement and innovation.

| Aspect | Description |

|---|---|

| Requirements Identification | Identify challenges and bottlenecks within financial operations that could benefit from AI and automation. |

| Tool Evaluation | Evaluate tools for integration with existing systems, scalability, compliance, user experience, and financial implications. |

| Vendor Engagement | Understand technical support and training provided by vendors. |

| Community and Ecosystem Support | Prefer tools with a strong community or ecosystem for additional resources and support. |

Implementation Best Practices for AI and Automation in FinOps

Embarking on the implementation of AI and automation within FinOps requires a methodical approach to ensure both immediate benefits and long-term success.

- Begin with a pilot project, selecting a specific area of your financial operations where AI can have a visible impact. This approach allows for the testing of theories and the refinement of processes on a smaller scale before a full-scale rollout.

- Engaging stakeholders early and often is crucial; their input and buy-in can significantly influence the smooth adoption and integration of new technologies. Establish clear communication channels to address concerns, share progress, and gather feedback.

- Incorporate training and development programs to equip your team with the necessary skills to navigate the new tools and technologies. Emphasize the importance of data quality and consistency from the outset, as the output of AI and automation tools is only as good as the data fed into them.

- Regularly review and adjust your implementation strategy based on performance metrics and user feedback, remaining flexible to pivot as needed.

- Finally, ensure that cybersecurity measures are integrated into every stage of the implementation process, protecting your organization’s data integrity and privacy.

By adhering to these best practices, you can facilitate a seamless transition to AI-driven FinOps, unlocking efficiency and innovation.

| Aspect | Description |

|---|---|

| Pilot Projects | Start with a pilot project to test and refine processes before full-scale rollout. |

| Stakeholder Engagement | Engage stakeholders early to influence smooth adoption and integration of new technologies. |

| Training and Development | Provide comprehensive training and development programs for team adaptation to new tools and technologies. |

| Data Quality and Consistency | Emphasize data quality and consistency from the outset. |

| Cybersecurity Integration | Ensure cybersecurity measures are integrated at every stage of the implementation process. |

Navigating Challenges and Mitigating Risks

The journey to integrate AI and automation into FinOps is fraught with both challenges and risks, demanding a proactive and strategic approach to navigation and mitigation.

- A primary challenge lies in ensuring data quality and integrity, as AI systems rely heavily on the input data for generating reliable outputs. Organizations must implement robust data validation and cleansing processes to address this issue.

- Another significant challenge is the resistance to change within teams, which can be mitigated by fostering a culture of innovation and providing comprehensive training and support to ease the transition.

- Risk management is integral, particularly in assessing the security vulnerabilities that come with the integration of new technologies. Establishing stringent cybersecurity protocols and regularly updating them in accordance with evolving threats is crucial. Additionally, the risk of non-compliance with regulatory standards can be minimized by ensuring that the chosen AI and automation tools are in strict adherence to industry regulations and ethical guidelines.

- Furthermore, the financial implications of integrating AI and automation tools present another risk area. Careful financial planning and cost-benefit analysis are essential to ensure that the investment translates into tangible benefits without adversely impacting the organization’s financial health.

By strategically addressing these challenges and risks, organizations can navigate the complexities of integrating AI and automation into FinOps, paving the way for enhanced operational efficiency and strategic agility.

| Aspect | Description |

|---|---|

| Data Quality and Integrity | Implement robust data validation and cleansing processes. |

| Resistance to Change | Foster a culture of innovation and provide comprehensive training and support. |

| Cybersecurity Risks | Establish stringent cybersecurity protocols and regularly update them. |

| Regulatory Compliance | Ensure tools adhere to industry regulations and ethical guidelines. |

| Financial Planning | Conduct cost-benefit analysis to ensure investments yield tangible benefits. |

Measuring Success: Key Performance Indicators (KPIs) for AI-Driven FinOps

To effectively measure the success of integrating AI and automation into FinOps, identifying and tracking the right Key Performance Indicators (KPIs) is essential. These KPIs should reflect both the efficiency gains and the strategic value derived from the digital transformation initiatives.

- Firstly, cost savings and avoidance metrics offer insight into the financial impact of AI-driven processes, highlighting reductions in operational expenses and preventing unnecessary spending.

- Another critical KPI is the accuracy and timeliness of financial reporting, which indicates the improvement in data quality and the expedited preparation of financial documents.

- Additionally, the rate of automated transactions compared to manual ones serves as a benchmark for operational efficiency, showcasing the extent to which automation has streamlined routine tasks.

- Monitoring cloud utilization and optimization metrics is also crucial, as these reflect the effectiveness of dynamic resource allocation strategies in reducing waste and maximizing investment value.

- Lastly, employee productivity and satisfaction metrics should not be overlooked, as they signify the successful adoption of AI tools and the liberation of staff to focus on higher-value activities.

By systematically evaluating these KPIs, executive architects can provide quantifiable evidence of the benefits brought by AI and automation to FinOps, ensuring the organization remains aligned with its strategic objectives and continues to drive forward with innovation and efficiency.

| KPI | Description |

|---|---|

| Cost Savings and Avoidance | Measure reductions in operational expenses and prevention of unnecessary spending. |

| Accuracy and Timeliness of Financial Reporting | Assess improvement in data quality and expedited preparation of financial documents. |

| Rate of Automated Transactions | Benchmark operational efficiency by comparing automated versus manual transactions. |

| Cloud Utilization and Optimization | Reflect effectiveness of dynamic resource allocation strategies in reducing waste and maximizing investment value. |

| Employee Productivity and Satisfaction | Indicate successful adoption of AI tools and liberation of staff for higher-value activities. |

Future-Proofing Your FinOps Strategy: Staying Ahead with AI and Automation

To ensure your FinOps strategy remains resilient and agile in the face of future challenges, embracing continuous innovation in AI and automation is imperative. The rapid pace of technological advancement necessitates a forward-looking approach, where executive architects consistently evaluate and integrate emerging AI technologies and automation capabilities.

This proactive strategy involves staying abreast of AI trends, such as machine learning advancements, natural language processing improvements, and predictive analytics enhancements, to identify opportunities for further optimizing financial operations.

A key aspect of future-proofing your FinOps strategy lies in cultivating a culture of innovation and adaptability within the organization. Encouraging teams to experiment with new technologies and methodologies fosters an environment where innovation thrives, ensuring your FinOps framework can quickly adapt to new market conditions and technological evolutions.

Moreover, establishing a framework for continuous learning and development ensures your workforce remains skilled in the latest AI and automation technologies. Investing in training programs and knowledge-sharing platforms empowers employees to leverage new tools effectively, enhancing your organization’s capacity for innovation.

By maintaining a commitment to innovation, staying informed about technological trends, and fostering a culture of continuous improvement, executive architects can future-proof their FinOps strategy, positioning their organizations for sustained success in an increasingly digital world.

| Aspect | Description |

|---|---|

| Continuous Innovation | Consistently evaluate and integrate emerging AI technologies and automation capabilities. |

| Culture of Innovation | Foster an environment where experimentation with new technologies and methodologies is encouraged. |

| Continuous Learning and Development | Invest in training programs and knowledge-sharing platforms for staying updated with the latest AI and automation tools. |

Building Strategic Partnerships for Enhanced FinOps Efficiency

In the pursuit of elevating FinOps efficiency through AI and automation, forging strategic partnerships stands as a pivotal strategy. These partnerships, whether with technology providers, consultancy firms, or industry consortiums, provide access to a wealth of specialized knowledge, cutting-edge technologies, and best practices that can significantly accelerate the adoption of AI-driven processes.

By collaborating with partners that complement your organizational strengths and understand the intricacies of your financial operations, executive architects can tailor AI and automation solutions to address unique challenges effectively.

Such alliances also facilitate knowledge exchange, enabling teams to stay abreast of emerging trends and innovations in the FinOps arena. Additionally, partnerships can extend the scope of FinOps transformation beyond internal operations, encouraging a more collaborative approach across the ecosystem, including suppliers and customers.

This broadened perspective not only enhances operational efficiencies but also strengthens the strategic positioning of the organization in the marketplace. By strategically selecting and cultivating these partnerships, executive architects underscore their commitment to continuous improvement and innovation, ensuring that their organizations remain competitive and agile in an ever-evolving digital landscape.

| Aspect | Description |

|---|---|

| Strategic Partnerships | Forge partnerships with technology providers, consultancy firms, or industry consortiums for specialized knowledge and cutting-edge technologies. |

| Knowledge Exchange | Facilitate knowledge exchange to stay abreast of emerging trends and innovations in FinOps. |

| Collaborative Approach | Extend the scope of FinOps transformation to include suppliers and customers for enhanced operational efficiencies. |

Step-by-Step Process for Implementing AI and Automation in FinOps

Here is a step-by-step process for implementing AI and automation in FinOps:

- Assess current FinOps maturity: Evaluate your existing financial operations, identify bottlenecks, and determine areas where AI and automation can have the most significant impact.

- Define automation and AI goals: Set specific, measurable objectives for what you aim to achieve with process automation solutions and AI, such as reducing manual data entry, accelerating report generation, or achieving real-time cost analytics.

- Select the right tools: Choose fintech process automation tools that offer advanced predictive analytics, automated cost optimization, anomaly detection, and root cause analysis capabilities aligned with your goals.

- Develop a data governance strategy: Implement a robust strategy for data collection, storage, and security to ensure AI systems have access to high-quality data for generating reliable insights.

- Implement and monitor: Integrate the chosen AI and automation tools into your workflows, continuously monitor their performance, and be prepared to iterate and refine your strategy as needed.

- Establish foundational processes and governance: Focus on implementing robust controls and mechanisms to ensure accountability, transparency, and compliance, providing a solid foundation for efficient cloud financial management.

- Leverage expert guidance: Engage with experienced partners like PwC to support you in establishing a mature FinOps practice, unlocking the full potential of AI in the digital era.

- Incorporate guardrails: Establish guidelines that act as safeguards to mitigate risks and align AI projects with organizational goals, creating a more controlled and predictable environment for managing AI system costs.

- Accommodate change: Build agility into your cost forecasting models to accommodate the high degree of change in both unit rate costs and engineering deployment options for AI services.

- Engage with the FinOps community: Join and contribute to the rapidly evolving AI technology landscape by interacting with the FinOps AI Slack channel and staying up-to-date with the latest best practices and insights.

By following these steps, organizations can effectively integrate AI and automation into their FinOps strategy, optimizing costs, enhancing efficiency, and driving innovation in the cloud.

Integrating FinOps with DevOps Practices

Integrating FinOps principles into DevOps practices is crucial for achieving cost efficiency and optimizing cloud resource utilization. By aligning the goals and processes of both disciplines, organizations can foster a culture of cost awareness and accountability throughout the software development lifecycle.

- One key aspect of this integration is sharing FinOps data with DevOps teams. By providing developers and operations personnel with visibility into cost metrics, usage patterns, and financial insights, they can make informed decisions during the design, development, and deployment stages. This empowers them to optimize resource allocation, select cost-effective services, and proactively identify opportunities for cost savings.

- Collaboration and communication between FinOps and DevOps teams are essential for successful integration. Establishing regular meetings, check-ins, and shared dashboards facilitates the exchange of ideas, challenges, and best practices. This helps break down silos, align priorities, and ensure that cost optimization strategies are effectively implemented across the organization.

- Leveraging automation is another critical component of integrating FinOps with DevOps. By incorporating cost monitoring and optimization tools into the DevOps toolchain, organizations can automate cost tracking, anomaly detection, and resource rightsizing. For example, integrating cost management APIs into CI/CD pipelines enables real-time cost analysis and alerts, allowing teams to identify and address cost inefficiencies early in the development process.

- Adopting serverless architectures and containerization technologies, such as AWS Lambda and Kubernetes, can further enhance the synergy between FinOps and DevOps. These approaches enable granular cost allocation, automatic scaling based on demand, and efficient resource utilization. By optimizing serverless functions and container configurations, teams can minimize costs while maintaining performance and reliability.

- However, integrating FinOps with DevOps is not without challenges. Technical complexity, organizational silos, and differing levels of maturity can hinder effective collaboration. To overcome these obstacles, organizations should invest in training and upskilling programs that promote a shared understanding of FinOps principles and best practices among DevOps teams.

- Establishing a culture of experimentation and continuous improvement is also crucial. Encouraging DevOps teams to test new cost optimization strategies, evaluate their impact, and share lessons learned fosters a mindset of innovation and accountability. By embracing a data-driven approach and leveraging FinOps insights, teams can iteratively refine their practices and drive long-term cost efficiency.

In conclusion, integrating FinOps with DevOps practices is a powerful approach for optimizing cloud costs and resource utilization. By fostering collaboration, leveraging automation, and promoting a culture of cost awareness, organizations can unlock the full potential of their cloud investments while delivering value to their customers.

If you liked this article, please share it and subscribe to my website. For consulting work, please visit my website, Shift Gear and I would be glad to help you in your requirement.

From Perplexity – Top 10 Searches for AI Tools. Check this also – GenAI Summit San Francisco 2024: Advancements and Impacts – Information Technology Trends & Current News | Shift GearX

Also Read: An Executive Architect’s Approach to FinOps

You will also love – The Power of AI Tools: Enhancing Decision-Making and Efficiency – Information Technology Trends & Current News | Shift GearX